Buying property with post-handover payment plan in UAE?

Aquarius.homes News

Post handover payment plans getting popular

While generous post-handover payment plans of up to ten years from real estate developers have provided an important resource for many residents who had been priced out of Dubai’s property market, these schemes have also opened an avenue for overseas buyers to consider investing in Dubai real estate. The post-handover plans are best suited for both end users and overseas investors as the buyers don’t have to put all the money at once, which gives them the leverage to buy a bigger property as the payment is spread for a few years.

With property prices at their most affordable, combined with sweet deals from developers, it is definitely the best time to consider property investment options in Dubai. For the investor, a post-handover plan becomes a compulsory saving, as part of the rent is used to cover the purchase price. So the buyer ends up saving seven per cent of the principle purchase depending on the length of the post-handover plan offered by the developer. For example, if it was a three-year post-handover plan, you would have saved an average of 21 per cent of the price, considering that a residential property offers a 7 per cent annualised return.

However, when an overseas investor buys a unit with a post-handover plan, there are several factors to consider. Payment options for off-plan and ready properties differ significantly from developer to developer. When an overseas investor doesn’t have a local bank account, this can be difficult to buy a ready property direct from the developer. In the current market, some developers require a much larger initial down payment and then allow the buyer to pay via bank transfer for the remaining stage payments, while others insist on one security cheque covering the full amount. However, if the overseas buyer can pay in cash and does not avail the payment plan, attractive discounts are offered by developers in return for receiving all the sales money in one go.

Cheque requirement

Developers typically require post-dated cheques to secure each installment of the purchase price. The developer encashes the relevant post-dated cheque when that payment comes due, which is not always viable for overseas buyer. However, there are developers who do not require post-dated cheques until handover. This can create problems during handover when buyers are unaware of this requirement. If the terms of the SPA cannot be complied with, then the buyer may be in default, and they may not be able to obtain a mortgage very easily to remedy that default.

Bank finance

Some developers have tied up with UAE banks to provide finance to non-residents. This happens only if the country where the investor resides is on the bank’s approved list of countries or if they meet certain requirements of the bank. Also, developers might sell down their revenue stream on the remaining payments post-handover at a discount, so they push the default risk onto the bank.

Leasing the unit

When an overseas buyer invests in Dubai property, seeking legal advice on the terms of the sale and purchase agreement can prove beneficial. It is not uncommon for a developer to restrict the buyer from leasing the property to a third party. Consideration should also be given to whether the overseas buyer’s tenant can register the lease with Rera on Ejari, so long as a no-objection certificate is obtained from the developer. This is because a title deed will not be issued in the overseas buyer’s name until the last installment of the purchase price is completed. For overseas buyers who do not have a UAE bank account or cheque facility, they might find it difficult to rent the property out or manage it without the assistance of a property management company.

Wire transfers

Given the inability of overseas buyers to issue post-dated cheques, certain wire transfer facilities are available. Commercial arrangements are done whereby the developer permits the overseas buyer to wire transfer the payment installments to the developer’s bank account. Some of the commonly used means of securing the payment from the buyer, are personal guarantee and a large upfront payment. In a personal guarantee, the developer could consider obtaining a personal guarantee from a UAE resident on behalf of the overseas buyer and also require the UAE resident to provide post-dated cheques in the event of default committed by the overseas buyer. The developer could consider securing a larger upfront payment, as then buyers would be more reluctant to default because of the substantial amount already paid to the developer.

Termination law

When a buyer defaults on payments, the developer could terminate the sale without the need of a court order, as per Dubai’s new termination laws for off-plan property. Some developers have a reputation for being lenient and understanding in respect of default, but others also have a reputation for not being so understanding. The investor must bear in mind that he does not get the title deed until the property is fully paid. Therefore, the developer generally has the upper hand because the property is difficult to deal without the approval of the developer, and the developer doesn’t have to look far to find an asset to enforce its rights.

Germany Island will be home of magnificent six-bedroom beach and lagoon villas.They are among The Heart of Europe’s most prestigious properties. Innovative sustainability features will be embedded in the beautiful design. And the Island’s public spaces will brim with the country’s rich cultural heritage. Interesting investment opportunity: 8.34% Guaranteed NET ROI per year for a duration of 12 years No Service Charges and No Maintenance Cost for 12 years The villa can be utilized for 2 weeks per year Freehold Title Deed for any Nationality >> To book a viewing or to buy click here

The five-star Floating Venice will be the world’s first luxury underwater vessel resort, bringing charm, serenity, and the culture of Venice to the tranquil shores of the Gulf. Whether in their rooms, dining, or simply relaxing; guests can enjoy the best of both worlds – stunning Dubai skyline views and, below the waterline, wide scenes of passing gondolas and the coral reefs and marine life below. Atmospherically, The Floating Venice will mix the culture of its European counterpart, from the splendour of the masked carnival to exclusive operatic performances, and more modern pursuits at the floating yacht club. Interesting investment opportunity: 8.34% Guaranteed NET ROI per year for a duration of 12 years No Service Charges and No Maintenance Cost for 12 years Hotel Unit can be utilized for 2 weeks per year Freehold Title Deed for any Nationality >> To book a viewing or to buy click here

Ever imagined having a golf course, lush parklands and vibrant experiences surrounding you? That's life at Kiara – spacious furnished apartments at DAMAC Hills. Find home in a tranquil golf community with a club house, community centre plus an array of unique attractions and amenities designed around you. Limited Time Only! Spacious furnished apartment in KIARA - DAMAC Hills From AED 555,555 (€ 135.000) with 3-year payment plan At Kiara in DAMAC Hills , discover welcoming furnished apartments that cater to every lifestyle. Here, you’ll wake up to merry sounds and sights, along with breathtaking views of the Damac Hills Golf Club Dubai. With a collection of beautifully appointed apartments in a superb location, every furnished home is artfully planned with large windows and wide open areas. The tasteful interiors, equipped kitchen and spacious bathrooms, along with a wide variety of world-class amenities make coming home a pleasure. >> To book a viewing or to buy click here

Sobha Creek Vistas - Dubai's standard of fine living. The residential project is the ideal location to refresh, connect and come alive. The development's 28-floor twin-towers are envisioned and designed to offer breathtaking views of some of the city's most beautiful destinations, including the Dubai Creek, Ras Al Khor Wild Life Sanctuary, Downtown Dubai and the Dubai Water Canal.

The garden space of a villa. The urban vibe of an apartment. Everything comes together at High Gardens , a limited edition living experience surrounded by the DAMAC Hills International Golf Club and the vibrant community at DAMAC Hills. High Gardens pairs modern architecture with innovative landscaping to create a refreshing lifestyle that changes with the seasons. Each terrace can be a canvas for horticulture, a space for reading or a setting for al fresco evenings with friends. The Community It's a well-established self-contained community comprising villas, apartments and a hotel residence. Home to the DAMAC Hills Golf Club Dubai, it also boasts nearly four million square feet of parkland offering various themed areas for relaxation and sports – including restful gardens and lakes, a skate park, stables, football field, tennis courts and more. Popular food trucks and a resident ice cream van serve the community, along with Spinneys and Carrefour supermarkets, Jebel Ali School, salons and cleaning services, a special Green Zone selling plants, and shuttle services to Mall of the Emirates, with more amenities coming soon.

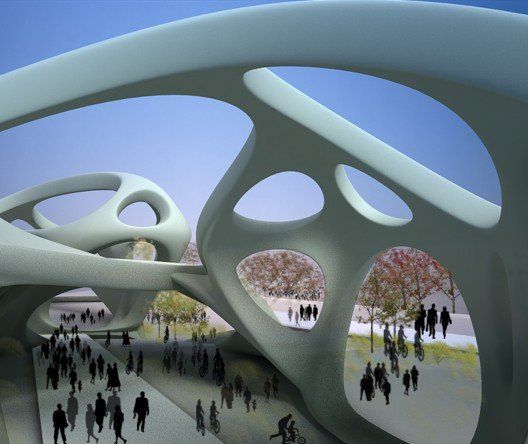

UN-Habitat and partners explore innovative solutions to cities threatened by rising sea levels On April 2019 UN-Habitat convened in New York with a broad range of partners the First UN High-level Roundtable on Sustainable Floating Cities, to explore innovative solutions to the threat faced by coastal cities and countries due to rising sea levels. The Roundtable, co-convened with OCEANIX, the MIT Center for Ocean Engineering and the Explorers Club, brought together innovators, explorers, marine engineers and scientists to the UN Headquarters to share cutting-edge ideas. Two out of every five people in the world live within 100 kilometers of the coast and one in ten lives in coastal areas less than 10 metres above sea level. The vast majority of coastal areas will be affected by coastal erosion and flooding, displacing millions of people, destroying homes and infrastructure. In support of UN-Habitat’s New Urban Agenda, OCEANIX CITY is a vision for the world’s first resilient and sustainable floating community for 10,000 residents on 75 hectares. The design is anchored in the Sustainable Development Goals, channeling flows of energy, water, food and waste to create a blueprint for a modular maritime metropolis. The city is designed to grow, transform and adapt organically over time, evolving from neighborhoods, to village, to cities with the possibility of scaling. Modular neighborhoods of 2 hectares create thriving self-sustaining communities of up to 300 residents with mixed-use space for living, working and gathering during day and night time. All built structures in the neighborhood are kept below 7 stories to create a low center of gravity and resist wind. Every building fans out to self-shade internal spaces and public realm, providing comfort and lower cooling costs while maximizing roof area for solar capture. Communal farming is the heart of every platform, allowing residents to embrace sharing culture and zero waste systems. Solutions The ocean covers two thirds of the planet. It is a vast resource that can help solve the complex challenges coastal cities face. We build for people who want to live sustainably across the nexus of energy, water, food, and waste. We build smart, but most importantly, we build a thriving community of people who care about the planet and every life form on it. Net-Zero Energy Fresh Water Autonomy Plant-Based Food Zero Waste Systems Shared Mobility Habitat Regeneration To learn more visit: www.oceanix.org or www.unhabitat.org - all pictures by OCEANIX/BIG-Bjarke Ingels Group.